Business

Embedded Auto Insurance: Should You Buy Insurance at the Dealership?

Purchasing a new car is thrilling—new smells, new features, and a big milestone in life. But just as you’re about to drive off the lot, the dealer offers you embedded auto insurance—a convenient option rolled into your car purchase. It sounds simple, but is it really a smart move?

In this comprehensive guide, we’ll explore what embedded auto insurance is, its pros and cons, and whether it’s a worthwhile option. Plus, we’ll share actionable tips on consistency, mental wellness, building good habits, and staying motivated during complex decision-making moments.

What Is Embedded Auto Insurance?

Embedded auto insurance refers to an insurance policy that’s bundled directly into the vehicle purchase process—usually at the point of sale in the dealership. Instead of shopping separately for car insurance, you’re offered a ready-to-go policy as part of your financing or purchasing package.

Pros of Buying Embedded Auto Insurance at the Dealership

1. Convenience at Checkout

You don’t have to spend days comparing quotes or filling out forms. The dealer handles everything on the spot.

2. Faster Coverage Activation

You drive away insured. There’s no delay or risk of forgetting to get coverage after the purchase.

3. Bundled Deals

Some dealers offer discounts on financing or vehicle price when you opt for their insurance plan.

4. Integrated Tech and Maintenance

In tech-savvy cars, the insurance might be usage-based and connected to real-time vehicle data. You pay based on how safely or how much you drive.

Cons of Embedded Auto Insurance

1. Limited Comparison

One of the biggest drawbacks is that you might not get the best deal available in the market. The dealer usually offers insurance from a single partner or a limited panel.

2. Higher Premiums

Bundled insurance can sometimes come with hidden fees or higher rates due to the added convenience.

3. Less Transparency

Dealership staff may not be licensed insurance agents. This limits their ability to explain policy exclusions, terms, and conditions properly.

4. Long-Term Costs

An upfront bundled policy might lock you into a more expensive contract that becomes a burden over time.

Should You Say Yes to Embedded Auto Insurance?

The short answer: it depends on your situation. If you’re someone who values convenience, doesn’t have time to shop around, and the dealer offers a competitively priced plan, it might work.

However, if you’re keen on saving money, getting a tailored policy, or if you’re already familiar with insurance shopping, it’s wise to get quotes from multiple insurers before saying yes at the dealership.

Smart Tips to Make the Right Insurance Decision

Making a big financial decision like this can be overwhelming. But with the right habits, mindset, and strategies, you can stay clear-headed and consistent throughout the process.

💡 1. Maintain Consistency in Financial Research

Set a schedule when you’re car shopping. Devote an hour daily to researching:

- Insurance quotes

- Terms and conditions

- Online reviews of insurance companies

This consistency will help you spot patterns and red flags easily.

Pro Tip: Use comparison tools like The Zebra, Policygenius, or Insurify before heading to the dealership.

2. Protect Your Mental Wellness

Big purchases can trigger anxiety. To keep stress in check:

- Take breaks during research.

- Practice deep breathing before signing any paperwork.

- Talk to someone you trust about the decision.

Mental clarity leads to better financial decisions.

3. Build Productive Financial Habits

Start developing habits that support your financial well-being:

- Track your car-related expenses (fuel, insurance, maintenance).

- Automate bill payments.

- Set monthly budgeting reminders.

These habits will serve you long after you’ve driven off the lot.

4. Real-Life Motivation: Zara’s Story

Zara, a 28-year-old software engineer from Lahore, almost bought insurance at the dealership. She was tired, rushed, and just wanted to finish the paperwork. But something felt off.

“I paused, told the dealer I’d think about it, and spent two hours comparing policies online,” Zara says. “I found a better deal with more coverage for Rs. 5,000 less per year.”

That decision gave her not just financial savings but a feeling of empowerment. Sometimes, slowing down is the smartest move.

Questions to Ask Before Buying Embedded Auto Insurance

Here’s a quick checklist to help you evaluate:

What is the premium compared to market rates?

Is the coverage comprehensive or limited?

Are there any hidden charges or fees?

Can I switch insurers later without penalty?

Who do I contact for claims and servicing?

If the answers are unclear, it’s okay to say “I’ll think about it” and do more research.

Final Verdict: Think Long-Term, Not Just Convenience

Embedded auto insurance offers one major benefit—ease. But ease doesn’t always mean value.

If you’re someone who values clarity, personalization, and control over your finances, take a step back and compare your options. But if your schedule doesn’t allow for much research and the dealership offers a trusted insurer, it could be worth considering.

Whatever you choose, be sure it aligns with your goals, mental wellness, and financial habits.

Conclusion

When buying a car, every choice matters—including your insurance. Embedded auto insurance at the dealership might seem convenient, but a wise buyer balances ease with evaluation.

Stay consistent in your research, take care of your mental wellness during decision-making, and build productive habits to support long-term financial success. Whether you say yes or no to dealership insurance, let your decision be informed—not impulsive.

Quick Recap: Embedded Auto Insurance Tips

- Compare before committing

- Think long-term cost, not just short-term ease

- Protect mental clarity while making decisions

- Stick to consistent research habits

- Use real-life motivation to guide you

Business

Insuring an Electric Vehicle in 2025: What’s Different?

Introduction

Electric vehicles (EVs) are no longer the future—they’re the present. In 2025, more drivers are switching to EVs than ever before, thanks to government incentives, lower running costs, and environmental benefits. But when it comes to insuring an electric vehicle in 2025, things work a bit differently compared to traditional petrol or diesel cars.

In this article, we’ll explore exactly what’s changed in EV insurance, what new coverage options exist, and how you can save money while protecting your investment.

1. Why EV Insurance in 2025 is Different from Regular Car Insurance

While the basic principles of auto insurance remain the same—protecting your vehicle and covering liability—EV insurance policies in 2025 include new considerations such as:

- Battery Coverage: EV batteries are expensive, sometimes costing 30-40% of the car’s value. Insurers now offer specific battery replacement or repair coverage.

- Charging Equipment: Home charging stations and portable chargers are now insurable components.

- Software & Cybersecurity Risks: With connected EVs, software hacks and system malfunctions are covered under specialized policies.

- Green Incentives: Some insurers provide discounts for EV owners to encourage sustainable driving.

💡 Example: A Tesla Model 3 owner in 2025 might pay a slightly higher base premium than a petrol car owner but can reduce costs through eco-discounts and safe driving telematics.

2. Factors That Affect EV Insurance Premiums in 2025

a) Battery Type & Range

Longer-range EVs with advanced lithium-ion or solid-state batteries may have higher premiums due to repair/replacement costs.

b) Repair Costs & Availability

EV parts are still less common than traditional car parts, so specialized repair centers can charge more.

c) Vehicle Safety Ratings

Cars with advanced driver-assistance systems (ADAS) and autonomous features can lower premiums due to reduced accident risk.

d) Charging Infrastructure

Drivers with secure home charging stations may get lower premiums compared to those relying solely on public chargers.

3. New Coverage Options for EV Owners in 2025

Battery Replacement Coverage

Covers damage from accidents, manufacturing defects, or degradation beyond a certain threshold.

Charging Equipment Insurance

Includes damage to home wall chargers, portable chargers, and even public charging cables if vandalized.

Cybersecurity Protection

Covers losses due to hacking of the car’s operating system or theft of personal data from the vehicle’s software.

Green Replacement Coverage

If your EV is totaled, insurers replace it with a new model that meets higher eco-efficiency standards.

4. How EV Insurance Costs Compare to Traditional Cars in 2025

Many assume EV insurance is more expensive—but that’s not always true in 2025.

| Feature | EV Insurance (2025) | Petrol/Diesel Insurance (2025) |

|---|---|---|

| Battery Coverage | Yes | No |

| Charging Equipment | Yes | No |

| Green Incentives | Up to 20% discount | Not applicable |

| Repair Cost | Slightly higher | Lower |

| Cybersecurity Coverage | Yes | Rare |

Pro Tip: Combine your EV insurance with renewable energy home coverage for additional savings.

5. Tips to Save Money on EV Insurance in 2025

- Shop Around – Use comparison sites to find the best EV-specific deals.

- Install Security Features – GPS tracking and advanced alarms lower theft risk.

- Use Telematics – Safe driving behavior can earn you discounts.

- Bundle Policies – Combine EV insurance with home or life insurance.

- Ask for Green Discounts – Many insurers reward eco-conscious drivers.

6. Challenges EV Owners Face in 2025 Insurance

- Battery Warranty Limitations – Some warranties exclude certain damage types, making separate coverage necessary.

- Higher Repair Times – Specialized technicians can delay repairs.

- Limited Policy Awareness – Many drivers are unaware of EV-specific benefits.

7. Recommended Insurance Companies for EVs in 2025

(Based on current market trends)

- Progressive – Known for flexible EV policies and green incentives.

- State Farm – Offers comprehensive battery and charging equipment coverage.

- Allianz – Strong global coverage for international EV travelers.

8. Final Thoughts

Insuring an electric vehicle in 2025 is no longer a confusing process—it’s becoming more tailored, transparent, and eco-friendly. While some costs remain higher due to specialized repairs and battery coverage, the overall benefits outweigh the drawbacks. With the right policy, you can protect your EV, save money, and contribute to a greener planet.

External Link Suggestion:

Business

How AI Chatbots Are Changing the Way You Buy Car Insurance

In recent years, AI chatbots have transformed the way we interact with services — and car insurance is no exception. From instant quotes to policy recommendations, these virtual assistants are streamlining the buying process, saving time, and enhancing customer experience.

In this article, we’ll explore how AI chatbots are reshaping car insurance purchases, their benefits, challenges, and future trends you need to know in 2025.

1. What Are AI Chatbots in Car Insurance?

AI chatbots are automated virtual assistants powered by artificial intelligence and natural language processing (NLP). They can simulate human conversations, answer queries, and complete tasks like generating insurance quotes or processing claims.

In the car insurance industry, they’re integrated into websites, apps, and even messaging platforms to guide customers through the buying journey.

💡 Example: Platforms like GEICO’s Kate and Progressive’s Flo can help users calculate premiums, explain coverage options, and even recommend discounts — all in real time.

2. How AI Chatbots Simplify Buying Car Insurance

Gone are the days of long forms and multiple calls to agents. With AI chatbots, you can:

a) Get Instant Quotes

Instead of manually entering details on multiple insurer websites, AI chatbots can pull your data and instantly provide tailored premium quotes.

b) Compare Policies in Seconds

Chatbots can list policy benefits, exclusions, and costs side-by-side — saving you hours of research.

c) 24/7 Availability

Whether it’s midnight or a weekend, chatbots are always available to answer your queries.

d) Personalized Recommendations

By analyzing your driving habits, location, and budget, chatbots can suggest the best coverage for your needs.

3. Why AI Chatbots Are a Game-Changer in 2025

The 2025 insurance market is highly competitive. Consumers demand speed, transparency, and personalization — and chatbots deliver exactly that.

Cost Efficiency

Insurers save on manpower while customers save time.

Better Customer Experience

Quick responses and friendly interaction create a better buying journey.

Data-Driven Decisions

Chatbots learn from thousands of customer interactions, making their suggestions smarter over time.

💡 External Link: How AI is Transforming Insurance Industry – Forbes

4. Challenges of Using AI Chatbots in Car Insurance

While the benefits are massive, there are also challenges:

- Complex Queries: Chatbots still struggle with rare or complicated policy questions.

- Data Privacy Concerns: Sharing personal info with AI systems requires strong security.

- Human Touch: Some customers still prefer human agents for final decisions.

5. Real-World Examples of AI Chatbots in Car Insurance

- GEICO’s Kate: Answers questions about billing, policy, and coverage.

- Progressive’s FloBot: Provides quotes and personalized offers.

- Allstate’s ABIE: Assists with claims and policy management.

These systems are constantly learning and improving through machine learning algorithms.

6. The Future of Car Insurance with AI Chatbots

Experts predict that by 2027, AI chatbots will handle over 85% of initial car insurance inquiries. Future developments may include:

- Voice-Activated Chatbots for hands-free interaction while driving.

- Integration with Telematics to provide usage-based pricing instantly.

- Proactive Policy Updates based on lifestyle changes.

7. Final Thoughts

AI chatbots are no longer just a customer service add-on — they’re becoming the frontline of car insurance sales and support. With their ability to simplify processes, personalize recommendations, and operate 24/7, they’re revolutionizing how people buy car insurance.

In the next few years, expect AI chatbots to become even smarter, faster, and more integrated into our everyday lives — making the process of buying car insurance not just easier, but also more transparent and personalized.

Internal Link Suggestion:

- Best Auto Insurance Providers in 2025 (link to your blog)

External Link Suggestion:

Business

Insurance for Autonomous Vehicles: What You Need to Know

Introduction

The rise of autonomous vehicles (AVs) is transforming the way we think about transportation. From Tesla’s Autopilot to Waymo’s self-driving taxis, the future of mobility is here. But as cars become smarter, insurance for them is getting more complex. Who is responsible if there’s an accident—the driver, the car manufacturer, or the software developer?

In this guide, we’ll cover everything you need to know about insurance for autonomous vehicles, including coverage options, liability issues, costs, and legal implications in 2025.

What Are Autonomous Vehicles?

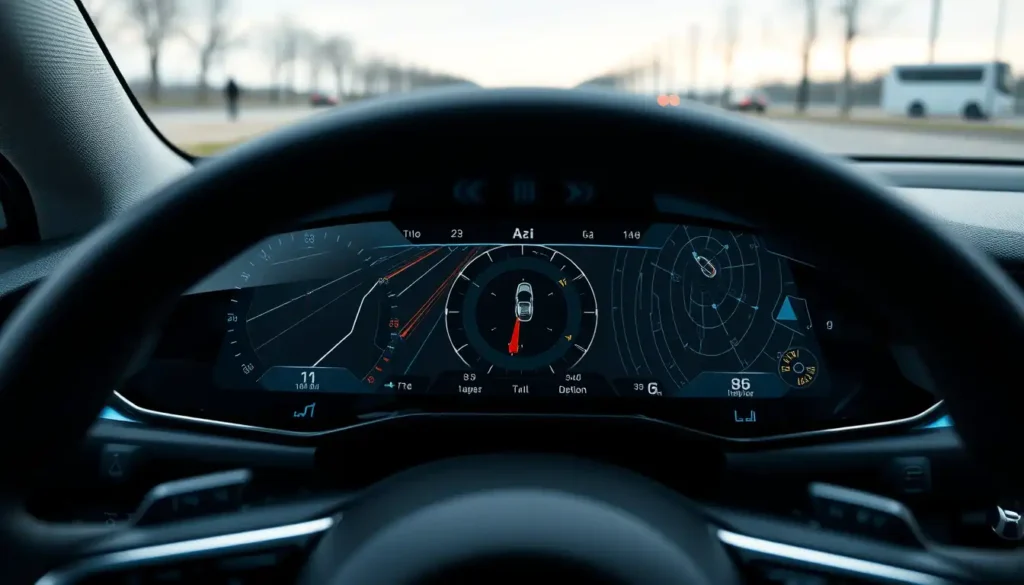

Autonomous vehicles, also known as self-driving cars, use AI, sensors, cameras, and LiDAR technology to operate without—or with minimal—human intervention.

They are categorized by SAE automation levels:

- Level 0: No automation

- Level 1-2: Driver assistance (adaptive cruise control, lane keeping)

- Level 3-4: Partial to high automation (car handles most driving but may require intervention)

- Level 5: Fully autonomous (no human driver needed)

Why Autonomous Vehicle Insurance is Different

Insurance for traditional cars is straightforward—you, as the driver, are primarily responsible for accidents. But with autonomous cars, responsibility shifts.

Key differences include:

- Liability Shift – Manufacturers or software developers may be held liable instead of drivers.

- New Risk Factors – Cybersecurity threats, software malfunctions, and sensor failures.

- Complex Claims – Determining fault requires data from the vehicle’s black box.

- Mixed Roads – AVs will share roads with human-driven cars, increasing unpredictable risks.

Types of Insurance for Autonomous Vehicles

Autonomous vehicle insurance is evolving, but common coverage types include:

1. Personal Auto Insurance

Still required for semi-autonomous cars (Level 1–3), covering:

- Liability for bodily injury & property damage

- Collision and comprehensive coverage

2. Product Liability Insurance

For Level 4–5 AVs, manufacturers may need this to cover design flaws, software errors, and sensor failures.

3. Cybersecurity Insurance

Protects against hacking, ransomware, and malicious interference with vehicle systems.

4. Data Privacy Insurance

Covers losses from data breaches involving passenger information.

5. Fleet Insurance

For companies operating multiple AVs (e.g., robo-taxis, delivery vehicles).

Who is Liable in an Autonomous Vehicle Accident?

Liability depends on the level of automation and cause of the accident:

- Human Driver Fault: If the AV is in manual mode, the driver’s personal insurance applies.

- Manufacturer Fault: If a defect in sensors, AI, or braking systems caused the crash.

- Software Provider Fault: If a navigation or AI decision led to the incident.

- Third-Party Hacker Fault: If a cyberattack disrupted the car’s functions.

📌 Example: In 2023, a semi-autonomous car accident in California led to a lawsuit against the manufacturer for a braking system malfunction.

How Much Does Autonomous Vehicle Insurance Cost in 2025?

Currently, insurance for AVs can be 10–20% higher than regular cars due to:

- Higher repair costs for advanced sensors & software

- Cybersecurity risks

- Unclear legal precedents

However, as accident rates drop due to automation, premiums are expected to decrease in the next decade.

Global Trends in Autonomous Vehicle Insurance

- USA: State-specific AV insurance laws, product liability focus.

- Europe: Strong data privacy and cyber insurance regulations.

- Asia: Rapid adoption of robo-taxis; governments pushing special AV insurance policies.

Challenges for Insurers

- Determining Fault – Requires advanced crash data analysis.

- Lack of Historical Data – AV accident statistics are still limited.

- Cybersecurity Risks – Insurers must factor in hacking scenarios.

- Changing Regulations – Laws differ across countries and states.

How to Choose the Right Autonomous Vehicle Insurance

When buying AV insurance, consider:

- Coverage for hardware & software failures

- Cybersecurity protection

- Legal liability clauses

- Data privacy coverage

- Reputation of the insurer in AV claims

The Future of Autonomous Vehicle Insurance

By 2030, we may see:

- Pay-per-mile AV insurance based on usage

- Blockchain-based claims processing for faster payouts

- Integrated manufacturer-insurer partnerships

- AI-driven premium calculation based on driving data

Internal Links

External Links

- National Highway Traffic Safety Administration – Autonomous Vehicles

- Insurance Information Institute – Self-Driving Cars

Conclusion

Insurance for autonomous vehicles is entering uncharted territory. As technology advances, insurers, lawmakers, and manufacturers will need to collaborate to ensure safe, fair, and affordable coverage for drivers.

If you own—or plan to own—a self-driving car, staying informed about liability, coverage options, and legal changes will be essential. The road ahead is exciting, but in the world of autonomous vehicles, knowledge is your best insurance.

-

Auto Insurance6 months ago

Auto Insurance6 months agoBest Auto Insurance Companies for Electric Vehicles in 2025

-

Car Insurance6 months ago

Car Insurance6 months agoComparing Online vs Agent-Based Car Insurance: Pros & Cons

-

Business6 months ago

Business6 months agoSubscription-Based Auto Insurance: Flexible Coverage for 2025

-

Insurance7 months ago

Insurance7 months agoHow to Lower Your Auto Insurance Premium Without Compromising Coverage (2023–2025 Edition)

-

Insurance8 months ago

Insurance8 months agoBest Auto Insurance for Low-Mileage Drivers: A 2023–2025 Guide

-

Insurance6 months ago

Insurance6 months agoHow Telematics Devices Affect Your Insurance Premium

-

Car Insurance6 months ago

Car Insurance6 months agoSmart Cars and Smart Policies: How Auto Insurance is Getting Smarter

-

Insurance7 months ago

Insurance7 months agoTelematics and Pay-Per-Mile Insurance: Are You Paying Too Much?