Auto Insurance

Top 10 Ways to Save on Car Insurance During Inflation

Inflation has made everyday expenses more challenging, and car insurance premiums are no exception. In 2025, rates in the U.S. have risen significantly, making it crucial for drivers to explore strategies to cut down costs without sacrificing coverage. The good news? There are multiple ways to save on car insurance and keep your finances balanced.

In this article, we’ll explore the top 10 practical ways to save on car insurance during inflation, ensuring you get maximum protection at minimum cost.

1. Shop Around and Compare Quotes

One of the simplest yet most effective ways to save on car insurance is comparing quotes from multiple providers. Rates can vary widely, even for the same driver profile. Use online platforms like The Zebra or Compare.com to get a clear picture.

👉 Tip: Get at least 3–5 quotes before making a decision.

2. Bundle Your Policies

Insurance companies often provide discounts when you bundle your car insurance with homeowners, renters, or life insurance. This can save you up to 15–25% annually.

If you already have another insurance policy, check if your provider offers a multi-policy discount.

3. Increase Your Deductible

Raising your deductible (the amount you pay before insurance kicks in) can lower your premium significantly. For example, increasing your deductible from $500 to $1,000 can cut your monthly payment noticeably.

⚠️ Just ensure you have enough emergency savings to cover the higher deductible if needed.

4. Maintain a Good Credit Score

In most U.S. states, your credit score directly impacts insurance premiums. Drivers with higher credit scores usually pay less.

Steps to improve credit score:

- Pay bills on time

- Reduce credit card debt

- Monitor reports for errors

5. Take Advantage of Usage-Based Insurance (UBI)

Many companies now offer pay-as-you-drive or usage-based insurance programs. These use telematics devices or mobile apps to track your driving habits. If you drive safely and less frequently, you can save up to 30%.

Popular UBI Programs:

- Progressive’s Snapshot

- Allstate’s Drivewise

- State Farm’s Drive Safe & Save

6. Ask About Discounts You Might Be Missing

Most insurers offer hidden discounts that many drivers overlook:

- Good student discounts

- Safe driver discounts

- Low-mileage discounts

- Military and veteran discounts

- Senior citizen discounts

💡 Always ask your provider which discounts you qualify for.

7. Reduce Coverage on Older Cars

If you own an older car with low market value, you might not need comprehensive or collision coverage. Dropping unnecessary coverage could save hundreds of dollars per year.

👉 Rule of thumb: If your car is worth less than 10 times your premium, consider dropping extra coverage.

8. Improve Vehicle Safety Features

Cars with anti-theft devices, airbags, backup cameras, and lane-assist technology often qualify for discounts. Even installing an aftermarket anti-theft system can reduce your insurance cost.

9. Drive Safely and Avoid Claims

A clean driving record is one of the biggest ways to save on car insurance. Speeding tickets, DUI, and accidents can skyrocket premiums.

Safe driving not only keeps you secure but also helps maintain low premiums over time.

10. Reevaluate Your Coverage Annually

Insurance needs change with time. Review your policy every year and check if:

- Your mileage has decreased

- Your car’s value has dropped

- You’re eligible for new discounts

Staying proactive ensures you’re not overpaying.

Final Thoughts

During inflation, managing expenses wisely becomes essential. By applying these 10 smart strategies to save on car insurance, you can significantly cut costs while still enjoying reliable coverage.

Start by comparing quotes, bundling policies, and improving your driving habits—small changes can lead to big savings.

🔗 Internal & External Links

Internal Link (example for your site):

External Links (high authority):

Auto Insurance

How to Lower Your Auto Insurance Premium in 2025

Car insurance is getting more expensive every year, and 2025 is no exception. With inflation, advanced vehicle technology, and rising claim costs, many drivers in the USA are searching for ways to lower their auto insurance premium. The good news is that insurance companies still offer several opportunities to reduce your rates if you know the right strategies.

In this guide, we’ll explore practical steps you can take in 2025 to cut down your auto insurance premium without compromising on coverage. From choosing the right policy to making lifestyle adjustments, you’ll find actionable tips that can help you save hundreds of dollars annually.

Why Auto Insurance Premiums Are Rising in 2025

Before we jump into saving strategies, let’s quickly understand why premiums are climbing:

- Advanced Car Technology: Modern vehicles have sensors, cameras, and AI-driven features. While safer, repairs cost more.

- Medical Inflation: Accident-related medical bills continue to rise, leading to higher claims.

- Climate Change Impact: More severe weather events mean increased accident and damage claims.

- Distracted Driving: Rising crash rates from smartphone use push insurers to increase premiums.

Knowing these factors will help you make sense of why lowering your auto insurance premium requires both smart shopping and responsible driving.

1. Shop Around and Compare Quotes

One of the easiest ways to lower your auto insurance premium is to shop around. Insurance companies calculate rates differently, so you might save hundreds by switching.

👉 Use tools like NerdWallet’s car insurance comparison or The Zebra to get multiple quotes instantly.

- Tip: Compare at least 4–5 insurers before making a decision.

📌 Image Placement Suggestion #1 (Banner Image)

- Prompt: “A family car parked in a suburban driveway with sunlight shining, symbolizing affordable auto insurance savings, clean professional stock photo style.”

- Alt Text: “Car in suburban driveway representing affordable auto insurance premium savings.”

2. Increase Your Deductible

A higher deductible means you’ll pay more out-of-pocket if an accident happens, but it lowers your monthly premium.

- Example: Raising your deductible from $500 to $1,000 could reduce your premium by up to 20%.

- Make sure you can afford the higher deductible in case of an accident.

3. Maintain a Good Credit Score

In most U.S. states, your credit score significantly affects your auto insurance premium. Insurers see drivers with higher credit scores as more reliable.

- Pay bills on time

- Keep credit utilization low

- Check your credit report regularly

👉 Internal Link Suggestion: Link this section to your own blog post on “How Credit Score Affects Car Insurance in the USA” (if you have one).

4. Bundle Policies with the Same Insurer

If you own a home or rent, bundling your auto insurance with home or renters insurance can save you up to 25%.

- Ask your insurer about multi-policy discounts

- Even bundling with life insurance sometimes brings savings

5. Use Telematics or Usage-Based Insurance

Many insurers in 2025 are offering usage-based programs where they track your driving habits using a mobile app or device installed in your car.

- Safe drivers can earn discounts of 15–40%

- Good for people who don’t drive often

6. Ask About Discounts You May Qualify For

Most drivers don’t realize how many discounts are available. Some common ones in 2025 include:

- Good student discount

- Defensive driving course discount

- Military or veteran discount

- Loyalty discount

- Low-mileage discount

👉 External Link Suggestion: Insurance Information Institute – Auto Insurance Discounts

7. Drive Safely and Keep a Clean Record

Nothing impacts your auto insurance premium more than your driving history. Avoiding tickets and accidents is the fastest way to lower rates.

- A single speeding ticket can raise your premium by 20–30%

- After 3–5 years of clean driving, you’ll qualify for safe driver discounts

8. Choose Your Car Wisely

Your vehicle type directly affects your insurance cost.

- SUVs and sports cars usually have higher premiums

- Family sedans and cars with strong safety ratings are cheaper to insure

- Consider insurance costs before buying a new car

9. Pay Annually Instead of Monthly

Many insurance companies charge extra fees for monthly payments. Paying the premium annually can save you up to 10%.

10. Review and Adjust Coverage Regularly

Don’t keep paying for coverage you no longer need.

- Drop collision/comprehensive coverage on older cars

- Reassess your policy every year to make sure it still matches your lifestyle

Final Thoughts

Lowering your auto insurance premium in 2025 is absolutely possible if you’re proactive. From comparing quotes and using telematics to driving safely and adjusting coverage, each step can save you money.

The key is to treat insurance like any other major expense—review it often, shop around, and take advantage of every discount available. With the right approach, you can cut costs without losing essential protection.

✅ Internal Link Example:

✅ External Link Example:

Auto Insurance

Why Car Insurance Rates Are Skyrocketing in 2025

Car insurance rates have become one of the hottest financial topics in 2025. Across the USA, drivers are shocked as premiums surge to record highs, putting extra strain on household budgets. Whether you’re a young driver, a family car owner, or a retiree, car insurance rates are climbing faster than ever before.

But why exactly are car insurance rates skyrocketing in 2025? Let’s break down the key reasons and explore practical strategies to help you save money despite rising premiums.

📌 Why Are Car Insurance Rates Rising So Fast?

The surge in car insurance rates is not random—it’s a perfect storm of economic, technological, and social factors. Insurers are dealing with higher risks and bigger costs than ever before, and those costs are passed on to policyholders.

1. Inflation and Economic Pressures

Inflation in 2025 continues to impact nearly every sector, and auto insurance is no exception. From car parts to repair services, everything has become more expensive. Insurance companies adjust their premiums to keep up with the rising cost of claims.

- Vehicle repair costs are up by 18% compared to 2023.

- Labor shortages in the auto repair industry add delays and higher bills.

- Medical treatment after accidents is more expensive due to healthcare inflation.

2. Expensive Vehicle Technology

Modern vehicles now come equipped with advanced sensors, self-driving features, and AI-powered safety systems. While these technologies improve safety, they also make cars far more expensive to repair or replace.

For example:

- A bumper replacement on a standard car once cost $500. On a 2025 EV with sensors, it can exceed $3,000.

- Electric vehicle (EV) battery replacement can cost $10,000+, making accident claims much higher.

3. Climate Disasters & Extreme Weather

Hurricanes, floods, and wildfires are occurring more frequently in the U.S. These natural disasters cause billions in damages, leading insurers to raise premiums to cover their increased risk exposure.

States like Florida, California, and Texas are seeing the steepest hikes in car insurance rates.

4. Rise in Accident Claims & Risky Driving

Post-pandemic driving patterns show more aggressive driving, distracted driving (due to smartphones), and an increase in DUI-related accidents. According to the National Highway Traffic Safety Administration (NHTSA), fatal crashes have risen by 12% since 2020.

Insurance companies are compensating for these higher risks by increasing premiums across the board.

5. Fraud and Litigation Costs

Fraudulent claims, staged accidents, and legal battles add billions in extra costs for insurers. Unfortunately, these costs are absorbed by consumers through higher car insurance rates.

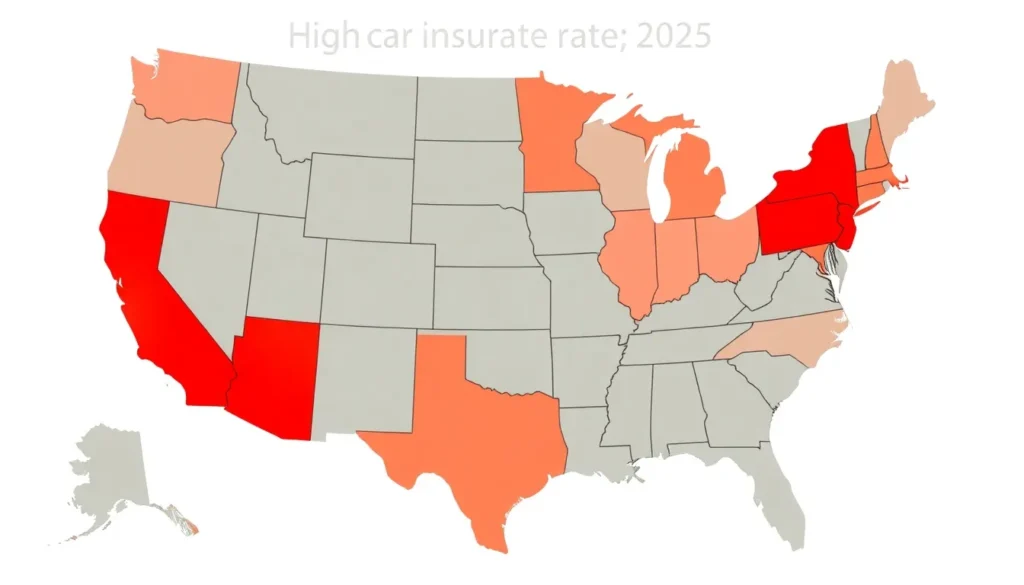

📌 Which States Have the Highest Car Insurance Rates in 2025?

While rates are rising everywhere, some states are hit harder than others.

- Florida – High hurricane risk + litigation culture = record-breaking premiums.

- Michigan – Expensive no-fault insurance laws continue to drive rates up.

- California – Wildfires and urban accidents raise risks.

- New York & New Jersey – High population density = more accidents, higher claims.

👉 Check the latest state-by-state car insurance averages here (external link).

📌 How Much Have Car Insurance Rates Increased in 2025?

According to industry data, car insurance rates in the U.S. jumped by an average of 19% from 2024 to 2025—the sharpest increase in over a decade.

- Average annual premium in 2024: $1,771

- Average annual premium in 2025: $2,106

That’s nearly a $335 increase per driver per year. Families with multiple vehicles are feeling this pinch even harder.

📌 How to Save Money on Car Insurance in 2025

Even though car insurance rates are climbing, there are strategies you can use to minimize costs.

✅ 1. Compare Quotes Regularly

Never settle for the first renewal price. Use comparison sites or independent agents to check multiple insurers. Sometimes, switching providers can save hundreds of dollars per year.

👉 Compare U.S. car insurance quotes here (external link).

✅ 2. Bundle Policies

Combine auto insurance with homeowners or renters insurance to unlock multi-policy discounts (up to 25%).

✅ 3. Increase Your Deductible

A higher deductible means lower premiums. If you rarely file claims, this option can help reduce yearly costs.

✅ 4. Maintain a Clean Driving Record

Safe drivers always get rewarded with lower premiums. Avoid speeding tickets, DUIs, and reckless driving violations.

✅ 5. Install Telematics or “Pay-as-You-Drive” Programs

Many insurers now offer discounts if you install a telematics device that tracks your driving habits. Safe drivers can save up to 30%.

✅ 6. Take Advantage of EV Incentives

Some states and insurers offer discounts for electric and hybrid vehicles because of eco-friendly policies.

📌 The Future of Car Insurance Rates Beyond 2025

Experts predict that car insurance rates may continue climbing unless inflation cools and accident trends improve. However, technology may also bring new solutions:

- AI-driven fraud detection could reduce false claims.

- Self-driving cars may reduce accidents over time.

- More usage-based insurance policies will tailor premiums to individual drivers.

Still, for now, drivers in 2025 need to adapt smartly and make informed choices to protect their wallets.

📌 Internal Links Suggestions

- Best Auto Insurance Companies for Electric Vehicles in 2025 (internal link)

- Why EV Insurance Is More Expensive (And How to Save) (internal link)

- Green Car Discounts: How Driving Electric Can Cut Your Premium (internal link)

Auto Insurance

Best Auto Insurance Companies for Electric Vehicles in 2025

Electric vehicles (EVs) are dominating U.S. roads, and while they’re eco-friendly and tech-packed, they also come with unique insurance needs. Finding the best auto insurance for EVs in 2025 is crucial if you want comprehensive protection without overpaying.

In this guide, we’ll explore the top insurance providers for EVs in the USA, compare their benefits, and give you insider tips to get the best rates.

Why EV Insurance is Different from Regular Auto Insurance

Electric vehicles often cost more to insure than gas-powered cars because of:

- Higher Repair Costs – EV parts, especially batteries, are expensive.

- Specialized Mechanics – Repairs require trained EV technicians.

- Advanced Tech – Sensors, cameras, and software increase claim costs.

- Battery Replacement Risks – A damaged EV battery can cost thousands.

For detailed reasons, see our Why EV Insurance Is More Expensive (And How to Save) guide.

Top 7 Best Auto Insurance Companies for EVs in 2025

Here’s a curated list of the most reliable EV insurers based on affordability, coverage, customer service, and EV-specific benefits.

1. State Farm – Best for Overall Value

Why it’s great for EVs:

State Farm is known for competitive rates and excellent customer service. For EV owners, they offer specialized repair network access and multiple discounts, including safe driver and multiple policy savings.

Key EV Benefits:

- Coverage for charging equipment.

- Roadside assistance for EV-specific issues (like charging failures).

- Generous multi-car discounts.

Average Annual EV Premium: $1,380

Website: State Farm Official

2. Progressive – Best for Tech-Savvy EV Drivers

Why it’s great for EVs:

Progressive shines with their Snapshot® program, which rewards low-mileage and safe EV driving. Their online tools make it easy to compare EV insurance rates.

Key EV Benefits:

- EV battery replacement coverage after accidents.

- Custom parts and equipment coverage for upgraded EV features.

- Charging station liability coverage.

Average Annual EV Premium: $1,420

Website: Progressive Official

3. GEICO – Best for Affordable EV Coverage

Why it’s great for EVs:

GEICO offers some of the most competitive EV rates in the country while maintaining excellent claims service.

Key EV Benefits:

- Optional mechanical breakdown coverage for EV components.

- Roadside assistance including flatbed towing for EVs.

- Charging station damage coverage.

Average Annual EV Premium: $1,350

Website: GEICO Official

4. Allstate – Best for Comprehensive Protection

Why it’s great for EVs:

Allstate’s coverage includes robust replacement cost options, making it ideal for expensive EVs like Tesla or Lucid.

Key EV Benefits:

- New car replacement coverage up to 2 years old.

- Accident forgiveness to keep rates stable.

- Smart home + EV insurance bundling discounts.

Average Annual EV Premium: $1,500

Website: Allstate Official

5. Nationwide – Best for Multi-Policy Discounts

Why it’s great for EVs:

Nationwide offers substantial savings when bundling auto and home insurance, perfect for EV owners who want an all-in-one policy.

Key EV Benefits:

- EV charging equipment coverage.

- Coverage for OEM (original equipment manufacturer) EV parts.

- Vanishing deductible rewards.

Average Annual EV Premium: $1,390

Website: Nationwide Official

6. Travelers – Best for Luxury EVs

Why it’s great for EVs:

Travelers provides high-limit liability and comprehensive coverage, making it a great choice for luxury EVs like Rivian or Porsche Taycan.

Key EV Benefits:

- New EV replacement coverage for total loss.

- OEM part replacement guarantee.

- Generous rental car reimbursement for long repair times.

Average Annual EV Premium: $1,580

Website: Travelers Official

7. Farmers – Best for Flexible Coverage Options

Why it’s great for EVs:

Farmers allows tailored EV policies with coverage for both personal and business use.

Key EV Benefits:

- EV battery coverage.

- Home charger installation protection.

- Rideshare coverage for EV drivers using Uber/Lyft.

Average Annual EV Premium: $1,410

Website: Farmers Official

Tips to Save on EV Insurance in 2025

- Bundle Policies – Combine home and auto insurance for up to 20% savings.

- Use Telematics – Safe driving trackers like Progressive Snapshot® can lower rates.

- Ask for EV Discounts – Some insurers offer up to 10% off for EV ownership.

- Improve Credit Score – In most U.S. states, better credit means lower premiums.

- Shop Annually – EV insurance rates can change quickly; compare quotes each year.

Which EV Insurance Should You Choose?

If you’re seeking affordable, reliable, and EV-friendly insurance, the top picks are:

- Budget-focused: GEICO or State Farm

- Tech-focused: Progressive

- Luxury EV owners: Travelers or Allstate

Final Thoughts

The best auto insurance for EVs in 2025 is one that balances cost, coverage, and service. As EV adoption grows, insurers are offering more tailored policies — so shop smart, ask about EV-specific perks, and compare quotes regularly.

-

Insurance2 months ago

Insurance2 months agoBest Auto Insurance for Low-Mileage Drivers: A 2023–2025 Guide

-

Insurance2 weeks ago

Insurance2 weeks agoHow Telematics Devices Affect Your Insurance Premium

-

Insurance2 months ago

Insurance2 months agoTelematics and Pay-Per-Mile Insurance: Are You Paying Too Much?

-

Insurance2 months ago

Insurance2 months agoThe Truth About Usage-Based Car Insurance

-

Insurance2 months ago

Insurance2 months agoHow to Lower Your Auto Insurance Premium Without Compromising Coverage (2023–2025 Edition)

-

Insurance2 months ago

Insurance2 months agoThe Truth About Full Coverage Auto Insurance: What Does It Really Include?

-

Business2 weeks ago

Business2 weeks agoPay-Per-Mile Car Insurance: Save Big by Driving Less

-

Business1 week ago

Business1 week agoHow AI Chatbots Are Changing the Way You Buy Car Insurance