Electric

Green Car Discounts: How Driving Electric Can Cut Your Premium

Switching to an electric vehicle (EV) is no longer just about saving on gas or reducing carbon emissions—it’s also about cutting costs on your auto insurance. More and more insurers in the U.S. are offering green car discounts to drivers who choose electric or hybrid cars. These discounts not only help policyholders save money but also encourage eco-friendly driving.

In this article, we’ll explore how green car discounts work, why insurers provide them, which companies offer the best deals, and how you can maximize savings while staying insured.

Why Insurers Offer Green Car Discounts

Car insurance companies in the U.S. are constantly assessing risk and promoting safer, sustainable driving habits. Offering discounts to EV owners makes sense for several reasons:

- Eco-friendly incentives – Insurers want to encourage drivers to adopt cleaner technologies.

- Lower long-term risks – EV drivers are often cautious, environmentally conscious individuals who statistically make safer driving choices.

- Government support – Federal and state policies push for green adoption, and insurers follow the trend to align with regulations.

- Lower maintenance risks – Fewer moving parts in EVs mean fewer mechanical breakdowns and potentially fewer claims.

How Green Car Discounts Work

Just like safe driver or good student discounts, green car discounts reduce your premium if you own an EV or hybrid. The discount can range between 5% and 20%, depending on the insurer.

Discount eligibility depends on factors such as:

- Vehicle type (hybrid, plug-in hybrid, or fully electric)

- State regulations (some states mandate EV-friendly policies)

- Insurance provider’s specific policies

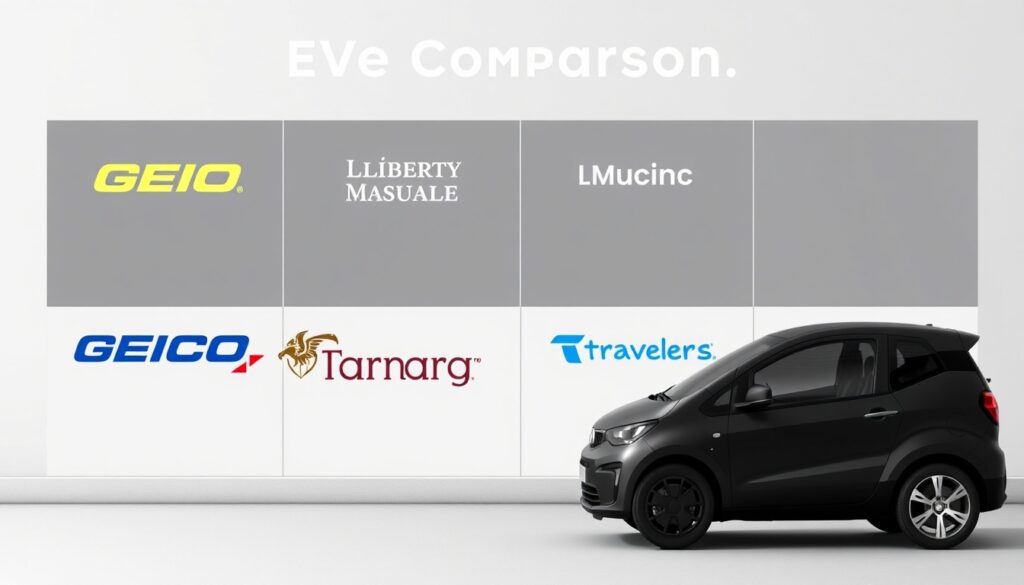

Major U.S. Insurers Offering Green Car Discounts (2025 Update)

Not every insurer offers green car discounts, but many of the top U.S. providers do. Here’s a quick breakdown:

- GEICO – Offers up to 10% green vehicle discount for hybrids and EVs.

- Liberty Mutual – Provides eco-friendly savings for alternative fuel cars.

- Travelers – Includes hybrid/electric discounts in several states.

- Farmers Insurance – Rewards EV owners with policy adjustments and perks.

- State Farm – Doesn’t always have direct EV discounts but compensates with safe driver and usage-based plans.

👉 Check out GEICO’s Green Vehicle Discounts (external link)

Other Ways EV Drivers Save on Insurance

Aside from green car discounts, EV owners can cut premiums through:

- Low-mileage discounts – If you drive less (common with EVs), insurers charge less.

- Bundling policies – Combine home, renters, and auto insurance for added savings.

- Usage-based insurance (UBI) – Programs like State Farm’s Drive Safe & Save reward careful EV driving.

- Safety features – Many EVs come with advanced driver-assist systems that qualify for safety discounts.

Challenges with EV Insurance Costs

While discounts help, EVs can sometimes cost more to insure due to:

- Higher repair costs – EV batteries and specialized parts are expensive.

- Limited repair shops – Not all garages can handle EV repairs.

- Vehicle value – EVs often carry higher upfront prices, which impacts coverage.

That’s why green car discounts play a crucial role in balancing out higher premiums.

Future of Green Car Discounts in the U.S.

With the EV market booming, insurers will likely expand green car discounts further. By 2030, experts predict:

- More states mandating green discounts

- Usage-based insurance dominating EV policies

- AI-driven premiums customized for EV usage and sustainability

Tips to Maximize Green Car Discounts

- Shop around – Compare multiple insurers before finalizing a policy.

- Ask specifically about EV discounts – Some aren’t openly advertised.

- Consider UBI programs – EVs often perform better under telematics monitoring.

- Bundle policies – Combine auto with home/renters insurance.

- Leverage tax credits + insurance savings – A double win for EV owners.

Internal Links (Your Other Blogs)

- Why EV Insurance Is More Expensive (And How to Save) (internal link)

- Best Auto Insurance Companies for Electric Vehicles in 2025 (internal link)

Conclusion

Green car discounts are becoming a key financial incentive for U.S. drivers making the switch to electric vehicles. While EVs may carry higher upfront insurance costs, these eco-friendly discounts, combined with tax benefits and advanced safety features, help balance the equation.

As insurers expand their sustainable offerings, driving electric will not only help you cut emissions but also lower your premiums—making it a smarter financial and environmental choice.

-

Insurance2 months ago

Insurance2 months agoBest Auto Insurance for Low-Mileage Drivers: A 2023–2025 Guide

-

Insurance2 weeks ago

Insurance2 weeks agoHow Telematics Devices Affect Your Insurance Premium

-

Insurance2 months ago

Insurance2 months agoTelematics and Pay-Per-Mile Insurance: Are You Paying Too Much?

-

Insurance2 months ago

Insurance2 months agoThe Truth About Usage-Based Car Insurance

-

Insurance2 months ago

Insurance2 months agoHow to Lower Your Auto Insurance Premium Without Compromising Coverage (2023–2025 Edition)

-

Insurance2 months ago

Insurance2 months agoThe Truth About Full Coverage Auto Insurance: What Does It Really Include?

-

Business2 weeks ago

Business2 weeks agoPay-Per-Mile Car Insurance: Save Big by Driving Less

-

Business7 days ago

Business7 days agoHow AI Chatbots Are Changing the Way You Buy Car Insurance